TopX Online: Explore the Gambling World in Bangladesh

- TopX Casino: Your Guide to Gambling World in Bangladesh

- How to Start Playing at TopX Casino: Simple Registration

- Entertainment for Any Preference: Games and Features of TopX Casino

- Bonuses and Promotions at TopX Casino: Increase Your Chances of Winning!

- Is the TopX Casino App Available for Smartphone: What You Need to Know

- Fast and Safe Withdrawal at TopX Casino: What You Need to Know

- TopX Casino in Bangladesh: Your Safety is Priority

- Is Downloading App Worth It?

Welcome to the world of gambling and entertainment - TopX online! This unique platform has been created especially for Bangladeshi players where they can enjoy a wide range of casino games, real-time betting options, and exclusive bonuses. TopX Bangladesh is a trusted platform for an exciting gaming experience, known for its security and integrity. Join TopX today and start your journey to big wins. In the meantime, we will tell you about the features of this trusted casino.

TopX Casino: Your Guide to Gambling World in Bangladesh

TopX Casino has quickly won the hearts of players in Bangladesh with its huge selection of games, safety, and convenience. Whether you are a new or experienced player at the TopX official site, you will find the perfect combination of excitement and opportunity to win. All players have access to the casino app for comfortable play and thousands of games.

Discover TopX Casino in Bangladesh

To better understand what is TopX, we suggest exploring what the platform features. It has everything from classic card games to modern slots and live dealer games. TopX offers:

- A variety of games. Hundreds of slots, roulette, blackjack, baccarat, poker and more.

- Security. State-of-the-art data protection technology and fair play.

- Convenience. Simple and clear interface, fast registration.

- Live dealers. The feeling of a real casino without leaving home.

- Bonuses. Generous offers for beginners and regular players.

Join TopX Bangladesh and enjoy exciting games right now!

How to Start Playing at TopX Casino: Simple Registration

Do you want to test your luck at TopX official website or its official app? It's easy to create an account! We have prepared step-by-step instructions for you so that you can quickly and safely start playing your favorite games.

- Go to the website. Open the official TopX Bangladesh web page in your browser on your computer or mobile device

- Find the “Register” button. It is located at the top right corner of the page. Click on it.

- Fill out the registration form: you will need to provide:

- Cell phone number (in international format, including Bangladesh code).

- A valid e-mail address.

- A strong password (make up a strong password that you can easily remember).

- Currency (choose Bangladeshi Taka - BDT).

- Agree to the terms and conditions. Read the TopX Casino terms and conditions and check the box confirming your agreement.

- Verify your details. Make sure that all the information you have entered is correct. It is especially important to check your phone number and email address, as they may be required for further verification.

- Click the “Register” button. Once verified, click this button to submit your registration application.

- Wait for the confirmation. Registration is usually confirmed fairly quickly. You may receive a text message on your phone or an email with further instructions. You may need to confirm your e-mail address by following the link in the e-mail.

- Log in to your account. After successful registration, use your login (phone number or email address) and password to log in to your new TopX Casino account.

- Fund your account. After logging into your account, you will be able to fund your gaming account and start playing. TopX offers various deposit methods, choose the most convenient one for you.

Now you can choose from a huge variety of games presented on the TopX website and enjoy the excitement! Don't forget to familiarize yourself with the available bonuses and promotions before you play at TopX online.

Entertainment for Any Preference: Games and Features of TopX Casino

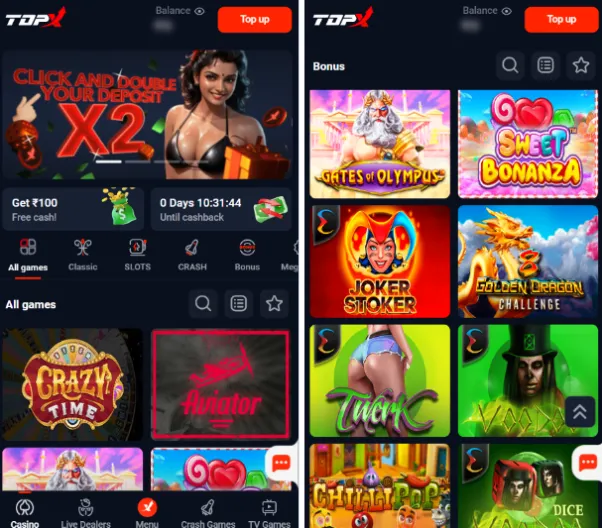

TopX betting site is a real paradise for gamblers! There are over 1,000 games to suit every taste, from exciting slots and classic table games to a live casino with professional dealers. The platform cooperates with leading software developers, which guarantees a smooth and exciting gaming experience.

Thousand Ways to Win: Explore the World of Games at TopX Casino

TopX Bangladesh has a huge collection of games to satisfy even the most sophisticated players. It's all here:

- Exciting slots. From classic fruit machines to modern video slots with stunning graphics and bonus rounds. Try to hit the jackpot!

- Classic table games. Blackjack, roulette, poker, baccarat - try your luck and skill at these popular games. Different variations of games will allow you to choose exactly what you like.

- Games with progressive jackpot. Dreaming of a big win? TopX Casino has progressive jackpot games where the winnings are constantly growing!

Want to find out what TopX play online? Check out the “Popular Games” section, where the most popular games among players are collected. And to increase your chances of winning, study the rules and strategies of each game. Don't forget that success in gambling often depends not only on luck but also on skill!

Immerse Yourself in the Atmosphere of a Land-based Establishment: Live Casino and Betting at TopX

TopX Live is a unique opportunity to experience a real casino from the comfort of your own home. Play with live dealers, watch the action in real time, and socialize with other players. There are a variety of games available at Live Casino:

- Roulette with live dealer: Place your bets and watch the roulette wheel spin.

- Blackjack with Live Dealer: Challenge the dealer in blackjack and show off your skills.

- Live Dealer Baccarat: Experience the excitement of this card game with a professional dealer.

- Poker with Live Dealer: Take part in a poker tournament from the comfort of your own home.

To play live games at the TopX betting site, simply select your favorite game and join the broadcast. The internet casino interface is very user-friendly and intuitive, so you'll get the hang of it in no time. Live Casino is a great choice for those who appreciate the realism and atmosphere of a real casino.

Bonuses and Promotions at TopX Casino: Increase Your Chances of Winning!

TopX Bangladesh offers its players generous bonuses and promotions to help them maximize their bankroll and have more fun while playing. From welcome bonuses to daily rewards, there is something for everyone.

TopX Welcome Bonus: Get Up to 20,000 Bangladesh Taka

New players at TopX Casino can get an incredible welcome bonus of up to 20,000 Bangladeshi Tak! This bonus will be a great start to your game. How to get it?

- Register on the TopX Casino website.

- Deposit your gaming account.

- The TopX bonus will be credited automatically.

Read the wagering terms and conditions to withdraw your winnings. The bonus usually needs to be wagered a certain number of times before it can be withdrawn. You can find details about the wager and expiration date of the bonus at the TopX official establishment in the “Bonuses and Promotions” section. Don't miss the opportunity to get additional funds for playing and increase your chances of winning big!

Refer a Friend Program at TopX: Get Rewards!

Share your experience of playing at TopX Casino with your friends and get rewards for it! The TopX refer and earn program is a great way to earn extra bonuses. How does it work?

- Log in to your TopX Casino account.

- Find the “Refer a Friend” or “Referral Program” section.

- Get your unique referral link or code.

- Share this link with your friends.

- When your friend signs up using your link and starts playing, you'll get a bonus!

The amount of the bonus for each friend you refer to may vary, so check the TopX Casino website for up-to-date information. The more friends you invite, the more bonuses you will get! This is a great opportunity not only to increase your bankroll but also to share your experience of playing at TopX with your friends.

In addition, those who are active in TopX play online can participate in other promotions. Follow the updates in the section “Bonuses and promotions” so that you don't miss the lucrative offers. Here you will find cashback, deposit bonuses, free spins, and much more.

Is the TopX Casino App Available for Smartphone: What You Need to Know

Do you want to enjoy your favorite games at Top X anytime, anywhere? It's easy! TopX offers convenient mobile solutions for Android and iOS devices, allowing you to play your favorite slots, table games, and Live Casino right from your smartphone or tablet.

How to Install TopX App on Smartphone: Instructions

A special TopX global app is available for Android users, which can be downloaded directly from the official casino website. The installation process is simple and intuitive:

- Visit the TopX Casino website from your Android device.

- Find the link to download the app (it is usually at the bottom of the page or in a special section).

- Download the APK file of the app.

- Allow installation of applications from unknown sources in the settings of your device (this is necessary to install APK files).

- Install the downloaded APK file.

- Launch the app and enjoy the game!

The TopX app for Android offers the full functionality of the web version of the casino.

Also, this TopX review would be impossible without mentioning the mobile solution for iOS users. When it comes to iPhone and iPad, you don't need to install a standalone app. You can create a shortcut on the desktop of your device for quick access to the web version of TopX Casino. This is done very simply:

- Open Safari and navigate to the TopX Casino website.

- Click on the “Share” icon (the square with the up arrow).

- Select “Add to Home screen.”

- Give the shortcut a name (for example, “TopX Casino”).

- Tap “Add.”

The TopX shortcut will now appear on your desktop like a normal application. Clicking on it will immediately take you to the casino site in Safari.

TopX App Functionality: How to Play with Comfort

The app contains all the same features as the official casino site. That is, after downloading the application you will get:

- access to several thousand games right on your phone;

- bonuses, including exclusive bonuses for installing the application;

- a quick response from the support team right in the app chat;

- quick access to your favorite games, start playing in one click, all you need is internet access at least 3G speed;

- start playing in one click, you do not need to re-authorize in the casino application.

In general, the choice is yours. Play TopX official or download the licensed app and have fun. The functionality will be the same

Fast and Safe Withdrawal at TopX Casino: What You Need to Know

TopX In understands that fast, reliable, and secure withdrawals are key to a comfortable gaming experience. That's why the process of receiving your honestly earned winnings at TopX Casino Bangladesh is made as simple, straightforward, and secure as possible. The team values your time and guarantees full transparency - no hidden fees.

How to Withdraw Your Winnings: Simple Guide

Withdrawing your winnings at TopX Bangladesh is very easy. After authorizing on the site, go to the “Cashier” section (usually it is easily found in the menu). In the “Cashier” section, select the “Withdrawal” tab. There are now two popular and reliable withdrawal methods available to players: bKash and Nagad. To withdraw, specify the amount and your wallet details and confirm the payment.

Carefully check all data before confirming the withdrawal request. The TopX website interface is intuitive, so the withdrawal process will not cause difficulties even for beginners.

Safety and Variety: Withdrawal Options at TopX

TopX is committed to providing the fastest payouts in the online casino market in Bangladesh. Most withdrawal requests are processed within 1-2 hours! TopX original website has chosen the most reliable and popular payment systems in Bangladesh - Nagad and bKash - to make your financial transactions as safe as possible.

Important points about withdrawal:

- Minimum withdrawal amount: 200 BDT. This makes the game accessible to players with different budgets.

- Maximum withdrawal amount:

- Nagad: 25,000 BDT.

- bKash: 20,000 BDT.

The casino guarantees the safety and confidentiality of your financial transactions. You can be sure that your funds are under reliable protection.

TopX Casino in Bangladesh: Your Safety is Priority

Playing at an online casino should be fun and exciting, but not worrying about the security of your funds and data. At TopX official, player safety is paramount. We work hard to create a safe and fair gaming environment for you. We offer you to find out how the platform protects players' data and whether TopX is safe or not.

Safety and Fair Play at TopX Casino: Your Peace of Mind is Our Job

TopX Casino takes security and fair play seriously. We utilize cutting-edge technology and enforce strict rules so you can enjoy your gaming experience without worrying about a thing. Here are just a few of the measures we take:

- Data Encryption. All your transactions and personal data are securely protected with state-of-the-art encryption methods. We use SSL certificates to ensure your information is kept private.

- Licensing and Regulation. TopX Casino operates in accordance with international standards and has the necessary licenses to prove the legality of our activities. We are regularly audited to ensure we meet the highest requirements.

- Fair play. The casino guarantees the fairness of all games presented on our site. The results of the games are generated using a certified random number generator (RNG), which eliminates the possibility of fraud or tampering.

- Privacy. The platform never shares your personal information with third parties without your consent. Your data is safe!

- Responsible Gaming. The casino creators encourage responsible gaming and provide players with the ability to set deposit and betting limits. The team also cooperates with organizations that help people facing gambling addiction.

Wondering is TopX safe? Don't even doubt that. The platform is honest and you don't have to worry about data or finances.

How to Make Sure TopX Casino is Legit: Checking is the Key to Confidence

Do you want to find an answer to is TopX legit? It's easy! Here are a few simple steps to help you check our reputation:

- Check the license. TopX Casino's license information is usually located at the bottom of the site. You can verify its authenticity by following the link to the licensing authority's website.

- Familiarize yourself with player reviews. Read other players' reviews of TopX Casino on independent forums and casino review sites. This will help you form your own opinion about our work.

- Pay attention to the security of the site. Make sure that the TopX Casino site uses HTTPS protocol and has an SSL certificate. This ensures that your data is transmitted encrypted.

- Contact the support team. If you have any questions or concerns, contact TopX Casino's support team. Our experts will be happy to answer all your questions.

When you choose TopX Casino, you choose safety, honesty, and reliability. Play with pleasure and do not worry about anything!

Is Downloading App Worth It?

TopX online is the perfect platform for players in Bangladesh. Here you'll find a huge selection of casino games, a convenient mobile app for on-the-go play, and safe, fast withdrawals. Join today and experience the real excitement! TopX Bangladesh is your choice!

FAQ

🚀 How to play TopX for free?

At TopX casino, there is an opportunity to play some games for free in demo mode. This allows you to familiarize yourself with the rules and features of the game without risking your money.

🎮 Where can I find the TopX casino app on my phone in Bangladesh?

The TopX app for Android can be downloaded from the official casino website. For iOS devices, a mobile version of the site is available, which opens in your browser.

🎁 What is the minimum deposit amount for the first bet at TopX?

The minimum deposit amount for the first bet in TopX may vary depending on the chosen deposit method. You can check this information on the casino website in the “Cashier” section.

💰 What bonuses will new players get at TopX?

New players at TopX can get a welcome bonus for the first 2 deposits - 500% of the amount.

Endorphinas HoT Puzzle

Guns and Dragons

Cashn Fruits 100 Hold and Win

Green Wizard Firze Blaze

Gemhalla

Gates Of Olympus

Coin Volcano

Gigantoonz

Story of Gaia

Book of Loki - Master of Illusions

Egypt Fire

Valentine Collection

Green Chilli

Immortal Ways Diamonds

Wilds of Fortune

Lucky Joker 40

Wild Cash

Sugar Rush

Lovely Lady Deluxe

Ballon

Chilli Bandits

Tiger Jungle

Rise of Merlin

Hotline

Magic Apple Hold and Win

Cricket X

Smoking Hot Fruits

Blazing 777

Green Chilli 2

Dragon Wealth

Rich Wilde and the Book of Dead

Gold Hit: O'Reilly's Charms

Lucky Lady PIN-UP

Idol of Fortune

Snatch The Gold

Wild Crowns

Fruit Machine Megabonus

Johnan Legendarian

Chance machine 100

Jewel Sea Pirate Riches

Thai Blossoms

Silk Road